What Is the Spot Market in Forex? A Beginner’s Guide with Examples

What Is the Spot Market in Forex? A Beginner’s Guide with Examples

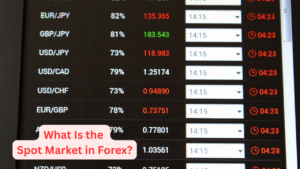

If you’re new to forex trading, one of the first concepts you’ll encounter is the spot market. It’s the most common and liquid segment of the foreign exchange market, where currencies are bought and sold for immediate delivery. But what exactly does that mean, and how does it work?

In this post, we’ll break down the spot forex market, explain how it differs from other types of forex trading, and walk through real-world examples to help you understand how traders use it to profit from currency movements.

📌 What Is the Spot Market in Forex?

The spot forex market is where currencies are traded at their current market price—known as the spot price—for immediate settlement. In most cases, “immediate” means the trade is settled within two business days (T+2), although some currency pairs like USD/CAD settle in just one day (T+1).

Unlike futures or options contracts, which involve agreements to buy or sell currencies at a future date, spot forex trades are executed on the spot—hence the name.

Key Characteristics of the Spot Forex Market

- ✅ Real-Time Pricing: Trades are executed at the current exchange rate.

- ✅ High Liquidity: The spot market is the most liquid part of the forex market, with trillions of dollars traded daily.

- ✅ Over-the-Counter (OTC): Most spot forex trading occurs directly between traders and brokers, not on centralized exchanges.

- ✅ No Physical Delivery: You don’t actually receive the currency. Instead, you profit (or lose) based on price movements.

- ✅ Leverage: Traders can control large positions with relatively small capital, increasing both potential gains and risks.

- ✅ Rollover Fees: If you hold a position overnight, you may earn or pay a small interest fee based on the interest rate differential between the two currencies.

🧠 Spot Forex Market Example

Let’s say you believe the euro will strengthen against the U.S. dollar. You decide to buy the EUR/USD currency pair at a spot rate of 1.1000.

- You buy 10,000 units of EUR/USD at 1.1000.

- The next day, the price rises to 1.1050.

- You close your position and sell at 1.1050.

Your profit is 50 pips (1.1050 – 1.1000), which equals $50 if you’re trading a mini lot (10,000 units). This trade was executed in the spot market, and you never actually received euros or dollars—just the profit from the price movement.

🔄 Spot Market vs. Futures Market

It’s important to understand how the spot market differs from other forex markets like futures and forwards.

| Feature | Spot Market | Futures Market |

|---|---|---|

| Settlement | T+2 (usually) | On a future date (e.g., 1 month later) |

| Delivery | Immediate (contractual) | Deferred |

| Trading Venue | OTC or exchange | Mostly exchange-based |

| Use Case | Speculation, hedging, arbitrage | Hedging, speculation, long-term planning |

While futures contracts are standardized and traded on regulated exchanges, spot forex trades are more flexible and accessible to retail traders.

💡 Why Trade the Spot Forex Market?

Here are a few reasons why traders prefer the spot market:

- 📈 Real-Time Opportunities: You can react instantly to economic news, geopolitical events, and market trends.

- 💰 Low Costs: Most brokers offer tight spreads and no commissions on spot forex trades.

- 🌍 24-Hour Access: The forex spot market operates 24 hours a day, five days a week, allowing for flexible trading schedules.

- 🔧 Customizable Strategies: Whether you’re a scalper, day trader, or swing trader, the spot market offers tools and liquidity to suit your style.

⚠️ Risks to Consider

While the spot forex market offers many advantages, it’s not without risks:

- ❗ Leverage Risk: High leverage can amplify losses just as easily as it can magnify gains.

- ❗ Market Volatility: Currency prices can move rapidly due to unexpected news or economic data.

- ❗ Overnight Fees: Holding positions overnight may incur rollover charges, which can add up over time.

✅ Final Thoughts

The spot market is the foundation of forex trading. It’s fast, flexible, and ideal for traders who want to capitalize on short-term price movements. Whether you’re just starting out or looking to refine your strategy, understanding how the spot forex market works is essential for long-term success.

By mastering the basics of spot trading, you’ll be better equipped to navigate the world’s largest financial market with confidence.